After raising taxes more than anytime in the history of the City of Puyallup, council mayor Jim Kastama and deputy mayor Dennis King blame everyone but themselves for their tax increases (and lie by saying city taxes went down, citing percentages compared to other tax districts) when they should just explain their actions.

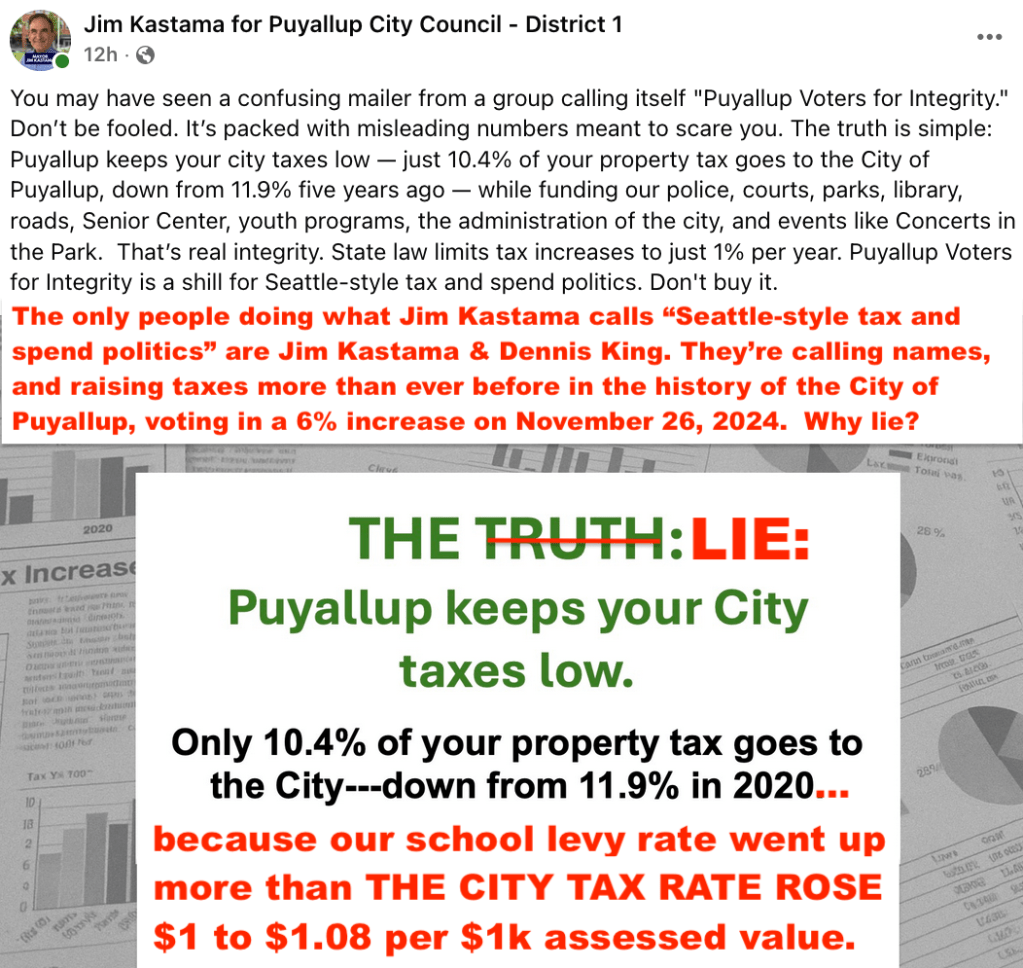

Like with his “Advertising Facts Without Including Any Facts” post on Facebook last weekend, current city council mayor Jim Kastama now posted a claim that the City’s portion of property tax went down from 11.9% to 10.4% when that’s the worst kind of logical fallacy possible: it’s an outright lie to say that our city taxes went down.

Kastama doesn’t want you to know that the reason the “percentage” of our tax bill changed is because our school payments went up even more than the city’s (not sure why yet) which caused all other taxing district percentages to look smaller in proportion. Even though we are paying more to the City of Puyallup now due to council’s 6% tax increase (in raw numbers ending up rising from $1.00 in 2024 to $1.08 in 2025 per $1,000 assessed value) we are also paying $4.21 instead of $3.33 per $1k assessed value to Puyallup Public Schools.

During the Puyallup City Council meeting on Tuesday, Kastama also used the diversion of blaming the state for higher taxes, but he didn’t mention the state portion of our tax bill increased 8 cents – exactly the same as the city, so it’s interesting he’s throwing shade everywhere else, instead of doing what he should – just trying to justify the tax increases. Dennis King didn’t say anything (again) in Tuesday’s city council meeting, but readers can check out our prior blog post responding to his ad hominen attack on PV4I which, after a diatribe of propaganda, does extensively try to justify all his tax increases.

The actions City Council took at Tuesday’s meeting were very telling: watch them scramble to be the first person to propose canceling the additional 1% tax increase they put on the agenda that night, knowing that voters were watching. The council member who got the nod from the mayor to propose the amendment stated that his reason was because the state had raised taxes higher than in Washington State history, but of course his urgency was really because voters in the city were watching now that it’s come to light that this council raised taxes more than ever before in city history.

That’s where the conversation should be: if we need to pay more for something, the incumbents running for re-election should just talk about why they think so. We don’t necessarily disagree on what the city needs, we disagree on how, as leaders of city council over the past 2 years, Kastama and King enacted various boondoggles: expensive, wasteful and via back-room deals. The projects could have been done affordably, but this council under the leadership of Jim Kastama and Dennis King has what they themselves call a “Seattle-style tax-and-spend” mindset using other people’s money.

As a reminder in case anyone is confused on what are the facts and what are the lies: go to your property tax breakdown, type your address number and street, and after getting into your page, click on Taxes/Values, scroll down to History and Receipts, and click again on Tax Area Code 096 for 2023 and 2024 which reflect taxes to be paid in 2024 and 2025.

The facts are, to pay for the renovation and 30 year rental of a police station we could have built and owned for $44 million, this council under Kastama and King decided to spend $73.5 million by:

- Raising city debt to the maximum limit allowed without public vote (on April 1, 2024)

- Increasing property tax by 6% (on November 26, 2024)

- Increasing electric and gas utilities tax rates by 1.8% (on August 26, 2024) to what is now 6.3% on our bills;

- Increasing cable tax rate by 1.6% (on August 26, 2024)

- Making staff cuts to the Puyallup Library, Senior Activity Center, Economic Development Manager, and other positions at City Hall (on November 26, 2024)

- Reallocating capital money from transportation to this project (on November 26, 2024)

- Replacing the transportation funds by increasing sales tax from 10.1% to 10.2% (on November 12 & 26, 2024)

The sales tax increase was accomplished by City Council creating a new Transportation Tax District. In its poll, PV4I is questioning why the Puyallup City Council made itself commissioners of the new tax district, rather than having the public elect Transportation Tax District commissioners. The property tax increase was accomplished by reversing 6 years of decisions made by prior councils which had declined to raise property taxes – state law limits cities to 1% increase in property taxes per year, but a loophole allows cities to override past decisions, while not being able to collect “lost” taxes back in time.

The large jump in City of Puyallup utility fees, included 5.5% increase in water rates, 7.5% increase in sewer rates, and a 16.5% increase in stormwater fees. As part of its campaign poll, PV4I is including questions about these municipal utility rate increases, as well as questioning expenditures from the utilities fund, specifically the use of $600,000 towards a

$5 million project rebuilding the 100 block of 9th St SW into what is was branded as a “festival street” alongside the Puyallup Fairgrounds, just 4 years after the same block was completely rebuilt for $2 million using the City’s general street fund.

And as a reminder on the police station project, the breakdown of costs in 2023 was projected to be $35 million for the police station, plus $9 million in shared groundbreaking expense if they had added a jail for an additional $31 million. That means a police station alone would have cost at most $44 million. The City of Puyallup has not commented on why it did not pursue that straighforward option, despite voters rejecting the 2023 bond (by 52.51% voting no) not because they opposed a police station, but due to the high cost and inclusion of a new jail. All other cities in Pierce County have closed their city jails, finding it more cost effective to use the New Pierce County Jail which was built in 2003 in part to take over housing of misdemeanor inmates from outlying cities like Puyallup as their jails aged.

What do you think? Take the Survey!

District 1 – District 2 – District 3

Please consider a donation of any amount, and invite your friends to like our Facebook page. Sponsored by Puyallup Voters for Integrity, PO Box 42, Puyallup WA 98371. No candidate or party contributes to, authorizes or controls this Political Action Committee which is registered at the Washington State Public Disclosure Commission. 2025 campaign season contributors over the $100 threshold so far include Chris Chisholm, PV4I Treasurer. When facts are presented, we want them to be accurate. If you find any errors, please email us with original-source evidence for correction.

Leave a comment